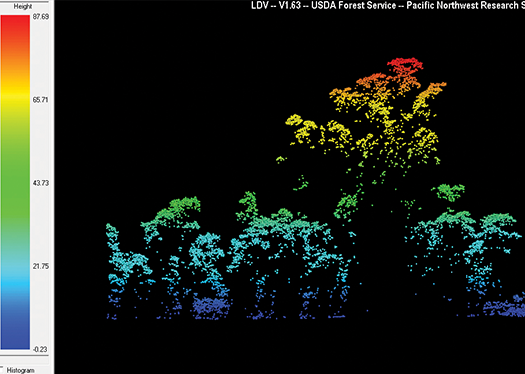

Efforts to assess baseline levels of forest carbon have involved biomass mapping in the Brazilian Amazon with the help of technology including Light Direction and Ranging (LiDAR). (Image courtesy of Eric Gorgens)

The idea behind forest-carbon credits is simple enough. It begins with the proposition that forests, to survive, must become more valuable intact than cattle ranching, mining and other activities poised to displace them. And for that to happen, the stewards of these forests must be paid sufficiently to ensure the trees stay standing. In practice, this concept has grown over a quarter century into myriad programs and proposals arrayed around a still-nascent voluntary carbon market. Forest communities earn money by selling credits based on measurable carbon-emissions reductions stemming from their forest conservation and restoration efforts. The buyers, usually businesses in industrialized nations, present the credits as proof that they are “offsetting” their own greenhouse-gas emissions by bolstering the carbon-sequestration ability of forests, largely in developing countries.

The results have been uneven at best. All along, there have been questions about the efficacy of forest-carbon credits. Critics say they simply allow global corporations to “greenwash” their ongoing CO2 output, undermining the goal of dramatically reducing overall world greenhouse-gas emissions. And fresh doubts have emerged over the accuracy of emissions-reduction monitoring underlying the credits, the fairness of credit prices, and whether Indigenous communities, often excluded from project planning, receive promised benefits. Though the private sector has directed billions of dollars to forest-carbon credits, it has become increasingly wary of the resulting controversy.

Proponents counter that carbon credits represent a useful tool-—particularly for countries in developing regions such as Latin America, where forests abound but climate-protection funds do not. “Our starting point is that carbon markets are not the only solution,” says Daniel Ortega-Pacheco, a former Ecuadorian environment minister who now consults on climate finance and the carbon market. “They have limitations, [but can] attract private investment that wouldn’t otherwise be available. They give countries with forests access to money.”

To ensure the effectiveness of forest-carbon schemes, Ortega-Pacheco and other experts are promoting an international effort to establish transparent standards for carbon credits, including those based on forest protection. He says greater confidence in carbon credits will benefit the market, adding: “The beauty of the voluntary market is that it doesn’t involve more debt.”

With 23% of the world’s forest cover, Latin America and the Caribbean could contribute and benefit substantially in the climate fight if carbon markets fulfill their promise. Conferees at the UN climate summit held two years ago in Glasgow, Scotland, pledged to halt and reverse deforestation by 2030, mindful that world forests absorb about a quarter of human-generated carbon dioxide emissions. But a 2022 UN study found public and private funding for such an effort was on pace to total just one quarter of what would be needed by 2025 to reach the target. The study also called for a “boldly increased forest carbon floor price” of US$30-50 per credit, each of which represents a one-metric-ton reduction in carbon emissions below past levels.

Since public-sector funding for conservation is limited, experts hope forest-carbon credits can help fill the gap. “We’re at the litmus test,” says Glenn Bush, an environmental economist at the Woodwell Climate Research Center. “Now we have real people who want to buy these credits.”

Many would-be buyers remain wary of the risks; but the funding potential is real, given the private sector’s ambitious decarbonization goals. The voluntary carbon market is estimated globally at US$2 billion a year, with about half of the credits rooted in projects involving forestry, land use and agriculture. Says Bush: “There are billions of dollars jockeying into this.”

Latin America has a three-decade history of selling forest carbon credits. Many are marketed directly by communities with the help of outside developers. But increasingly, sovereign forest-carbon credits are being issued by national or state governments with the goal of ensuring uniformity and transparency in standards and monitoring. Among the main problems the latter strategy aims to address is “leakage,” a situation in which improved forest protection in one area leads to increased land clearing in another.

The international community appears committed to making the carbon market work. At December’s UN Climate Change Conference in Dubai (COP28), the World Bank announced support for sovereign forest carbon credit initiatives in 15 countries, including Chile, Costa Rica, Guatemala, and the Dominican Republic. Also at COP28, Costa Rica and Ghana became the first nations to offer credits under the LEAF Coalition, an alliance of private-sector buyers and donor governments. Meanwhile, Peru, Guyana, Costa Rica and Colombia said they will join 11 other countries from Africa, Asia and Oceania to draft a road map aimed at boosting private-sector involvement in forest-carbon credits. And the six main independent agencies that certify carbon-emissions reductions promised to improve the transparency and consistency of their standards, an acknowledgement of concern over their accuracy.

Latin American countries have been experimenting with different schemes to sell carbon credits. Suriname, 90% of which is forested, is preparing to sell the first carbon credits under the UN’s program for protecting forests. The government expects to price the offsets at $30 per ton of cuts in emissions of carbon dioxide or greenhouse-gas equivalent. Belize and Honduras are now preparing audits of their emissions reductions under the UN’s forest-protection framework, an offshoot of the Paris Agreement known as Reducing Emissions from Deforestation and Forest Degradation (REDD+). These REDD+ credits can be sold to countries or private companies as Internationally Transferred Mitigation Outcomes (ITMOs) to offset the buyers’ own carbon emissions.

Brazil’s state of Tocantins signed a 10-year deal in June to sell credits to Mercuria, a Swiss energy-trading company. Tocantins state environmental officials say the deal could generate up to US$2 billion, covering credits issued from 2016 to 2032.

Forest advocates await plans by Latin America’s two largest economies, Mexico and Brazil, to create “cap-and-trade” emissions-trading schemes.” These will feature carbon-emissions limits on the largest companies, and require polluters that surpass them to pay a penalty or purchase offset credits. Mandatory programs such as these make up what are known as “compliance markets,” the largest of which are in Europe, California and China.

Mexico’s proposal is in the pilot stage, but is expected to take effect this year. Brazil’s plan is advancing through Congress and is expected to include offsets, but it has been weakened by an exemption granted to the country’s powerful agroindustry, a key source of emissions. Colombia has a carbon tax, allows for carbon offsets and is developing an emissions-trading scheme.

The recent case of Guyana, where 85% of the territory is forested, illustrates some of the challenges facing the voluntary carbon market. In Dec. 2022, Guyana said it had struck an agreement to sell US$750 million in credits over the coming decade to Hess Corp., a U.S.-owned oil company that is part of a consortium developing the country’s vast offshore oil reserves. The price begins at a minimum of US$15 a ton for credits covering 2016 to 2020 to a minimum of US$25 a ton for 2026-2030 credits.

The sale allows Hess to count those credits as it tries to reach what it calls “net-zero” carbon emissions. But just a quarter of human-generated CO2 emissions are soaked up by the world’s forests; the rest linger in the atmosphere for 300 to 1,000 years. And there’s no guarantee woodlands protected under a forest-carbon project one year won’t fall victim in a subsequent year to fires or government policy changes.

In addition, the Amerindian Peoples Association, an Indigenous human rights organization in Guyana, has challenged the carbon-credit sale. It argues that Indigenous communities were not adequately consulted by the agency that issued the credits, Architecture for REDD+ (ART). At the same time, though, the National Toshaos Council, which represents village captains of the country’s Amerindian and hinterland communities, says it supports the sale of credits and was fully consulted.

The credibility of carbon-credit schemes is also at issue in Colombia, where the Constitutional Court is weighing a complaint that a major forest-carbon project violated the rights of the Pirá Paraná, an Indigenous people in the country’s Amazon region. The case, taken up by the court in April 2023, could influence how consultation with Indigenous communities will be carried out in future such projects.

The Pirá Paraná say they were not properly consulted before the launch of Baka Rokarire, a REDD+ project that has sold over 1.5 million carbon credits to buyers that include Delta Airlines. The litigation centers on whether the Indigenous authority that endorsed the project in conversations with Masbosques, the Colombian nonprofit that developed it, was the right one. The disputes have fueled concerns that conservation projects undertaken for the voluntary forest-carbon market can exploit Indigenous communities, causing internal division and undermining their traditional forms of self-government.

“The governments of these countries have become experts in creating their own Indigenous groups,” says Levi Sucre Romero of Costa Rica, an Indigenous Bribri who coordinates the Mesoamerican Alliance of People and Forests, a grouping of Indigenous territorial authorities.

Criticism of carbon-credit markets grew sharply last year. An investigation published in January 2023 by The Guardian and other media into forest credits certified by Verra, one of the major carbon-standards agencies, asserted that over 90% of the credits did not represent real cuts in emissions.

Investigations by Bloomberg and then The New Yorker into South Pole, the world’s largest developer of carbon offset projects, followed, and subsequent studies backed up their findings. A report released in September by the University of California Berkeley Carbon Trading Project found Verra allowed project developers—typically companies or nonprofits—broad flexibility in the way they measured emissions reductions. The study also argued that many of the projects failed to protect the rights of Indigenous and local communities.

By the end of 2023, the chief executives of Verra and South Pole had resigned. Many companies began to back away from buying credits. Verra has revamped its methodology and was one of the six standards agencies that committed to improve transparency in Dubai.

The 2015 Paris Agreement recognized a role for carbon markets in meeting national emissions-reductions pledges under the accord. But disagreement over how strong to make those rules has stymied the development of a uniform regimen, illustrating how contentious carbon markets remain.

Two new international alliances have been set up to codify strong standards and boost confidence in the voluntary market.

The Integrity Council for the Voluntary Carbon Market (ICVCM), an oversight body for participants in the voluntary market, established what it calls Core Carbon Principles last year to ensure credits are transparent and have measurable impact. Ortega-Pacheco, who serves as co-chair of the ICVCM’s expert panel, says credits with these attributes will generate stronger demand. For its part, the Voluntary Carbon Markets Integrity Initiative (VCMI) provides a rulebook for companies using carbon markets as part of their efforts to decarbonize.

Just as pressing as transparency is the issue of prices. These can decline as projects, or countries, compete to sell carbon credits. And there are different ways to assess the value of forest carbon.

“In a natural system, a ton of carbon is very important,” says Bush of Woodwell. “In natural climate solutions [like forest conservation] the quality factors are not appreciated,” and the price can fall as low as $2 to $3 a ton.

But new global consensus on what decarbonization claims companies can credibly make could bolster interest in carbon credits, says Sarah Walker, director of REDD+ for the Wildlife Conservation Society (WCS). “How could prices go higher?” Walker asks, adding: “Demand.”

Companies appear willing to embrace requirements that make forest-carbon credits more impactful. The LEAF Coalition, for example, requires buyers to commit to emissions cuts in their supply chains; forest credits must be additional to those. LEAF’s floor price is $10 a ton, but if the initiative can catalyze the market, demand and prices for credits should increase, says Phil Brady, communications director for Emergent, the nonprofit that coordinates buyers and sellers in the coalition.

Daniel Nepstad, the head of the Earth Innovation Institute, which advised Tocantins on its sale of credits, warns that jettisoning carbon markets risks “throwing the baby out with the bathwater.” Many countries have set up multi-stakeholder processes to determine how to distribute forest credits, says Nepstad. He estimates that these efforts currently address one-third of the world’s tropical forests.

Debates about how to measure and pay for carbon credits mask the larger question of whether carbon credits can contribute powerfully to forest conservation. The case of Brazil shows that political will can be more effective than any permutation of forest credits. Since President Luiz Inácio Lula de Silva returned to power, deforestation has been reduced sharply. From January to November 2023, the rate of land clearing in the country’s Amazon region declined by 50.5%, according to Brazil’s Environment Ministry. The decrease prevented the release of an estimated 250 million tons of carbon dioxide equivalent, the ministry said.

If forest-carbon emissions reductions in the Amazon region were priced at $20 a ton, the credits would generate $4 to $5 billion, says Carlos Nobre, an earth system expert at the University of São Paulo’s Institute for Advanced Studies. That’s more income than would be produced if the land were cleared for cattle ranching, Nobre estimates, adding: “If the price of carbon credits goes to $20, $30, $40, then economically that makes more sense.”

But he notes this is unlikely to happen unless Brazil follows through on its cap-and-trade plan and creates a compliance market—one that includes agroindustry. If Brazilian companies were required to limit emissions, demand would increase for forest-carbon credits, which are now bought mostly by international companies in the voluntary market.

Experts say formalizing land-tenure rights for Indigenous and forest peoples, shown to be the most effective stewards of woodlands, offers another way to slow deforestation. Companies can also manage their supply chains to curb land-clearing by agroindustry, mining or logging interests. Carbon credit advocates argue all tools must be used. “There can be efforts to reduce emissions in supply chains and protect forests at the same time,” says Walker. “One of the things about climate change and forest loss is that we can’t have perfection be the enemy of the good. We need to use every lever possible.”

- Elisabeth Malkin

In the index: Deforestation associated with crop farming has made deep inroads in the Brazilian state of Mato Grosso. (Photo by Paralaxis/Shutterstock)

Forests’ role in absorbing CO2: vínculo